Solana at $199: Can a high-end suspension make a difference?

- The rise of Solana’s market, along with heavy recession activity, shows growth and increasing stability.

- Rising public scrutiny and open interest indicate strong market commitment, but caution remains about potential changes.

Solana [SOL] It has attracted a lot of attention, reaching a market capitalization of $94.04 billion and confirming its position in the market. This rise raises interest in whether Solana can sustain its momentum and lead a new altcoin rally or if volatility will intervene.

With an increasing enrollment and strong environment, SOL seems poised for growth. At press time, it is trading at $199.43, up 5.66%. Here’s a closer look at the factors shaping SOL’s path, from bankruptcy to public regulation and market sentiment.

Is SOL designed to explode or face uncertainty?

Solana’s market capitalization of $94 billion underlines its strong position in the crypto market. However, this growth comes with great volatility.

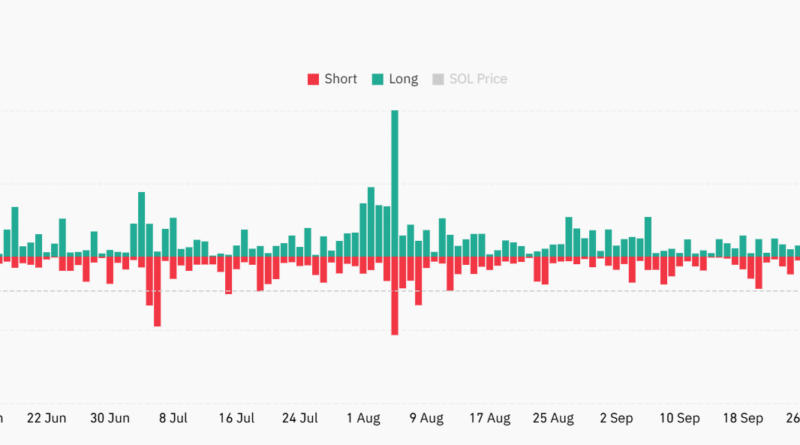

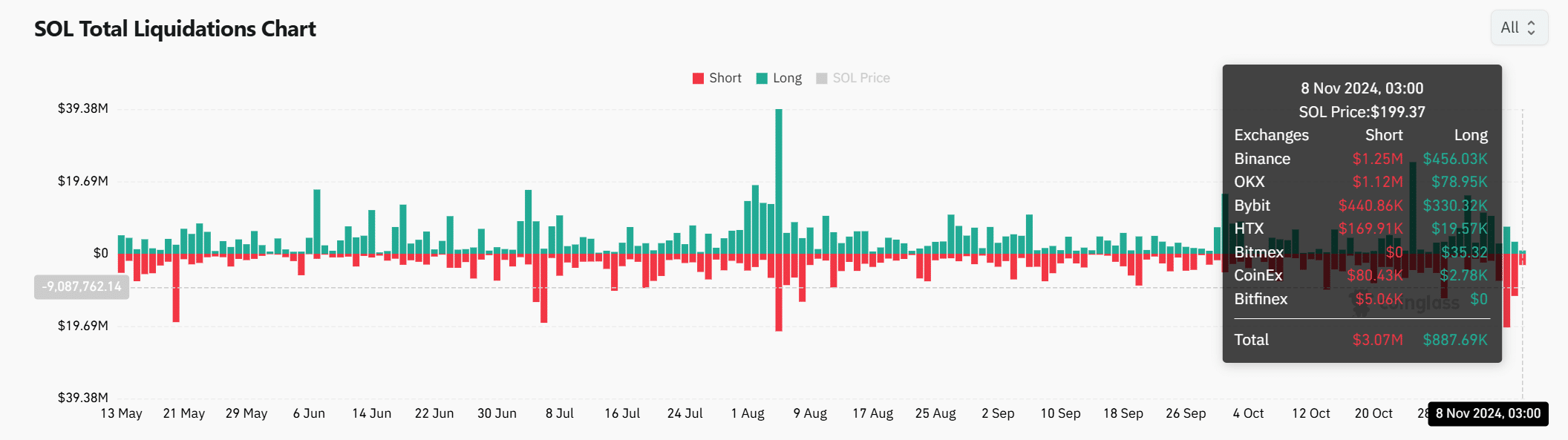

The SOL Total Liquidations Chart shows a high level of activity in both short and long positions. Recently, short losses reached $3.07 million, while long losses stood at $887.69K.

This imbalance suggests bullishness, with few traders betting against the SOL price. However, high levels of bankruptcy also indicate sudden price changes, indicating volatility in nature.

Therefore, while SOL’s growth is impressive, investors should remain aware of potential changes in the market.

Source: Coinglass

Public administration: Does hype drive the price of Sol?

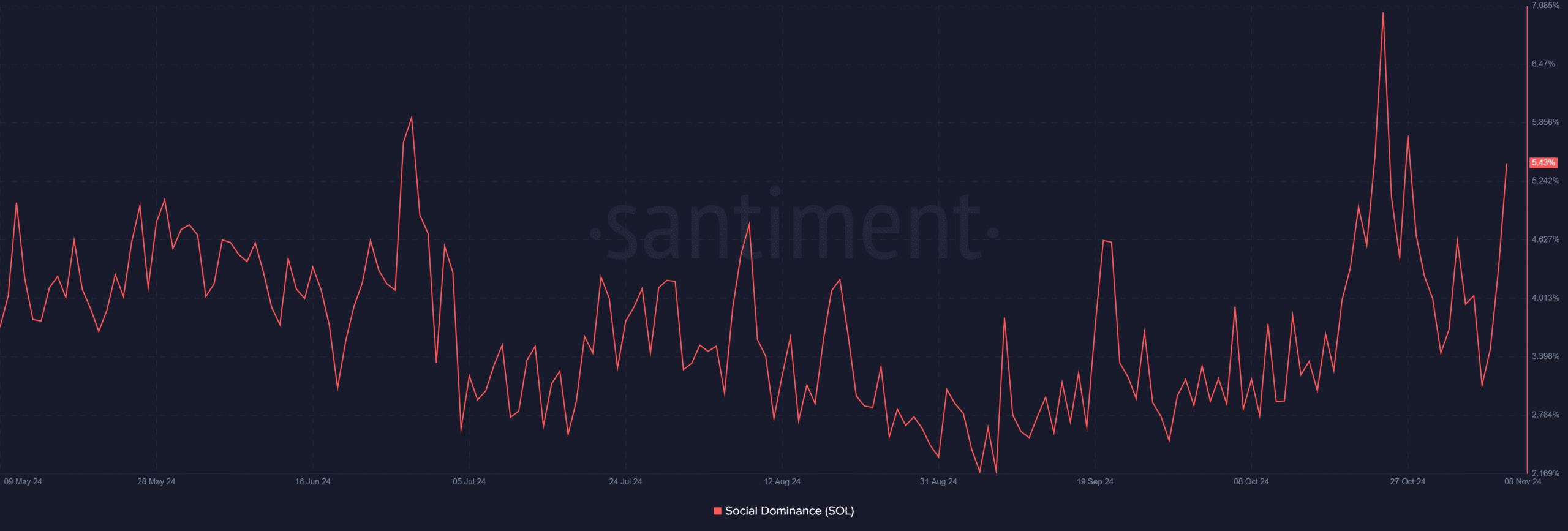

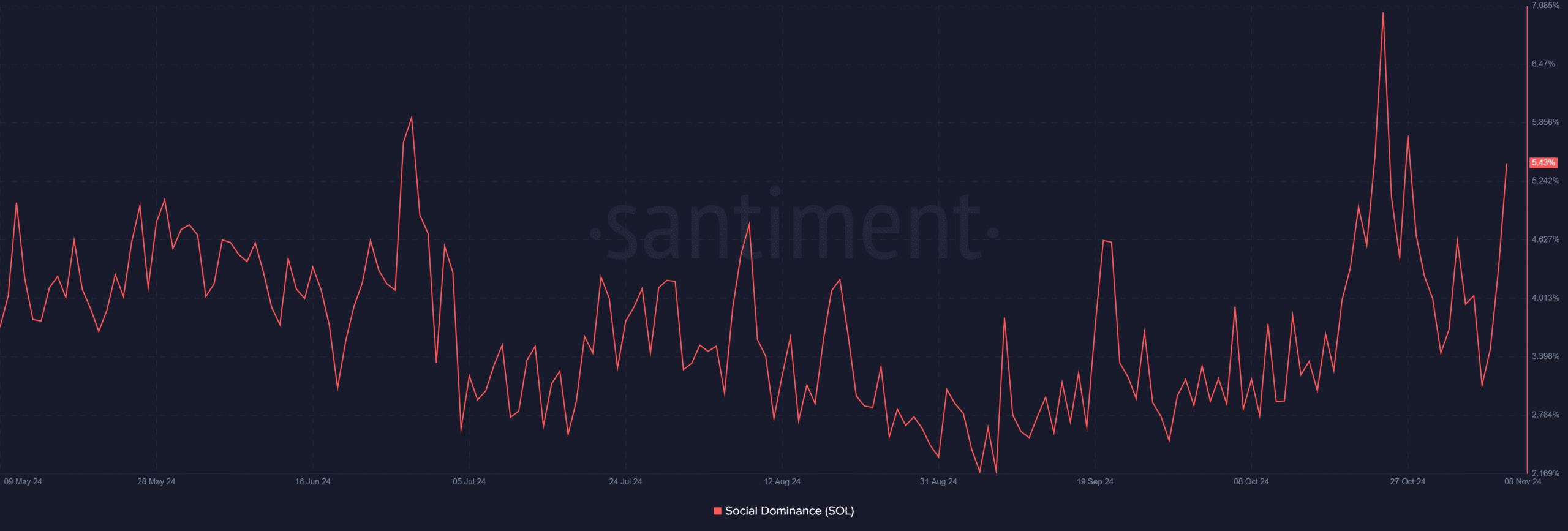

SOL’s public administration recently rose to 5.43% since November 8th. This increase in public interest reflects the increased focus on Solana within the crypto community.

Historically, increased social control is often accompanied by higher prices, as increased visibility attracts new buyers.

However, the rising public interest also presents risks. When hype exceeds fundamental growth, it can lead to temporary spikes followed by corrections.

Therefore, even if the increase in public authority can raise the price of SOL, investors should remain cautious about the speculative business that influences its strength.

Source: Santiment

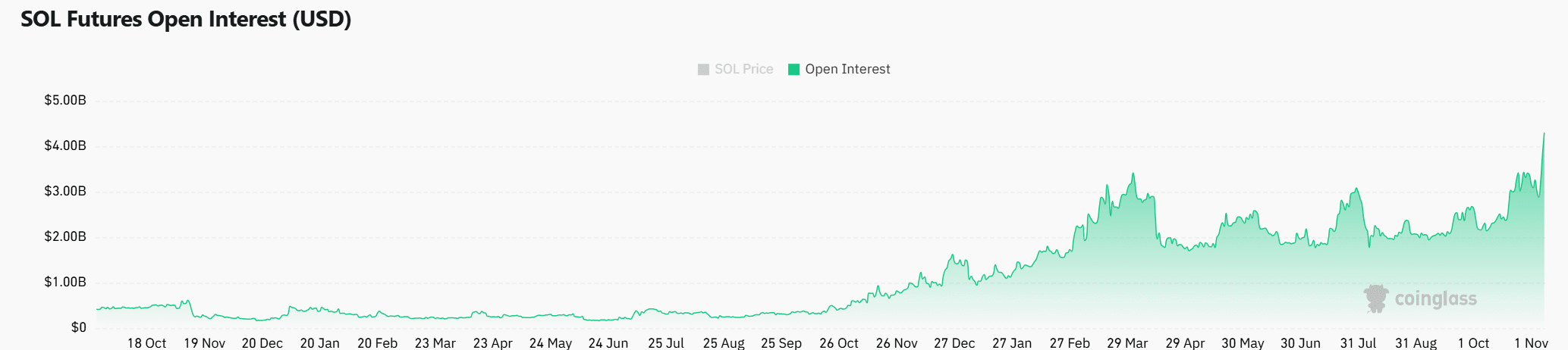

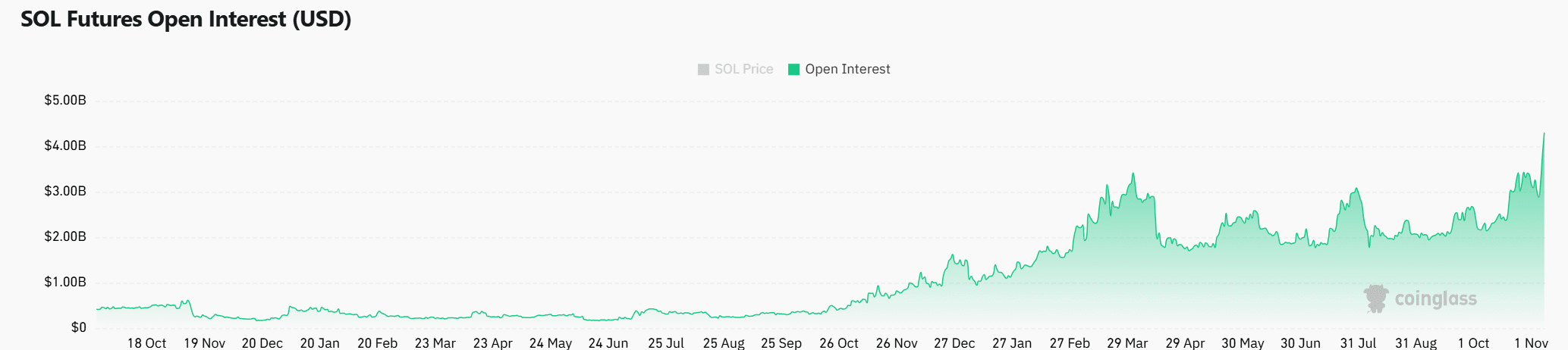

Open interest: Is rising interest a trading signal?

Solana’s open interest in futures increased by 14.24%, bringing the open interest to $4.38 billion. This increase reflects strong confidence in SOL’s ability to earn more profits.

Additionally, increased interest usually indicates strong market interaction, which can support higher momentum.

However, additional open interest can boost price movements, especially if highs start to decline under market pressure.

As a result, when this indicator appears to be strong, the risk of rapid change is still present, and traders should consider these factors before making decisions.

Source: Coinglass

Read on Of Solana [SOL] Price Statement 2024–2025

The end

Solana’s rise to $94 billion in market capitalization and trading price of $199.43 underscores its potential to lead the next crypto movement. However, the data reveal mixed signals. High levels of bankruptcy, increased public interest, and increased interest indicate the mood and uncertainty to come.

Therefore, although the future of SOL looks promising, it is facing possible corrections in the market. Traders should remain alert to this trend, as Solana’s next moves may set the tone for broader market trends.

#Solana #highend #suspension #difference